Mark Schniepp

October 10, 2023

General Condition Today

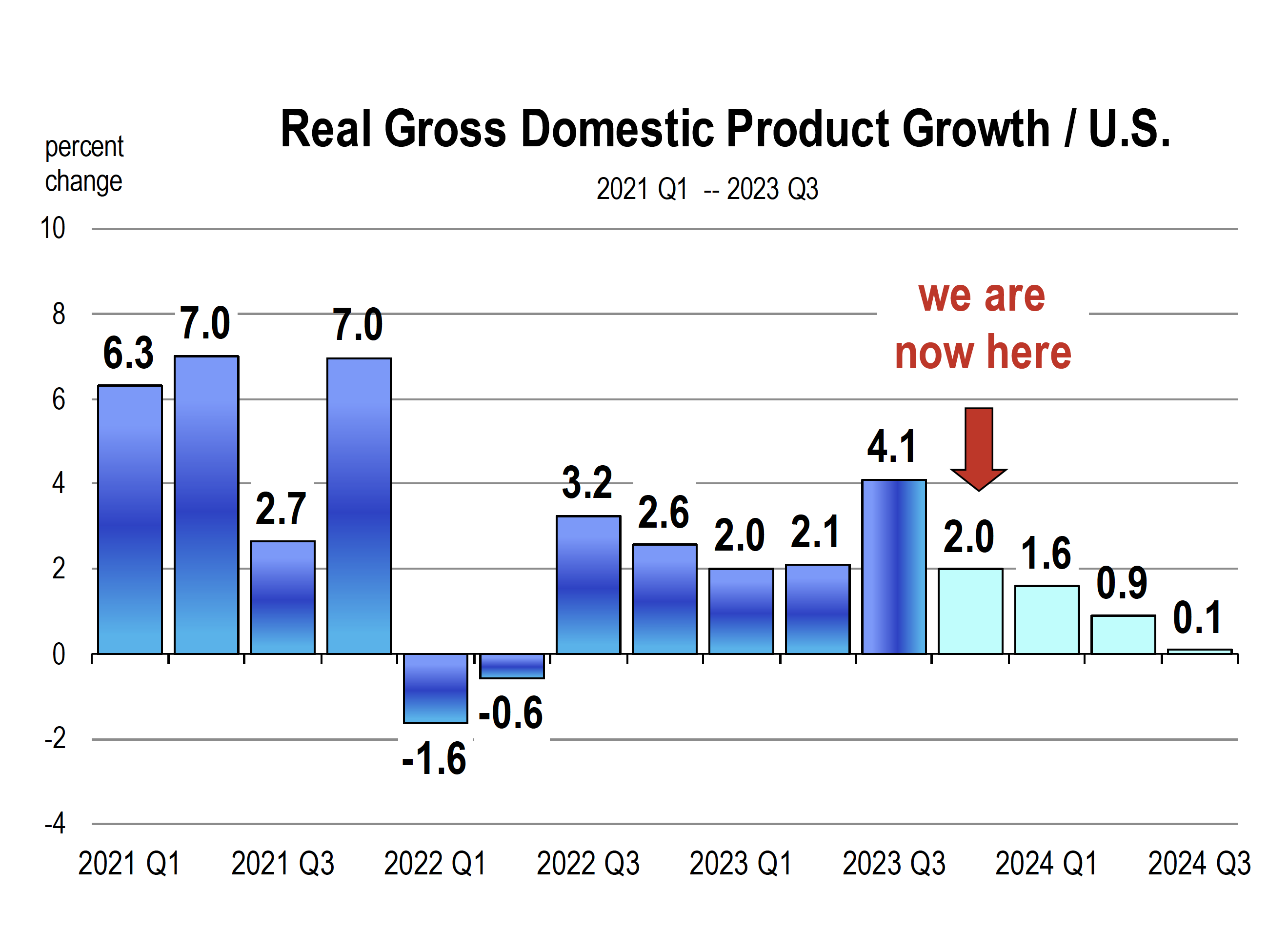

The economy continues to grow at a modest pace in 2023, though the third quarter that just ended will show accelerated growth of 4+ percent.

You as consumers are carrying the economy forward with your spending which is the key role in the growth of the economy this year

Despite high interest rates and persistent inflation, the outlook for recession has been cancelled for 2023. The labor markets remain too strong, but a change is coming.

There is still uncertainty whether the recession has merely been delayed or averted entirely.

Good News is Bad News

The September employment report indicated that twice as many new jobs were created than had been forecast by economists. In numbers, it was 336,000.

And this occurred in the wake of the 25,000 participants in the United Auto Workers strike. The unemployment rate remained at 3.8 percent. In California, the unemployment rate for the latest month—August—is at 4.6 percent.

The news is that the labor market remains strong. Typically that is good news. But good news about the labor market in the current environment is bad news for the Federal Reserve as its main goal now is to bring down inflation.

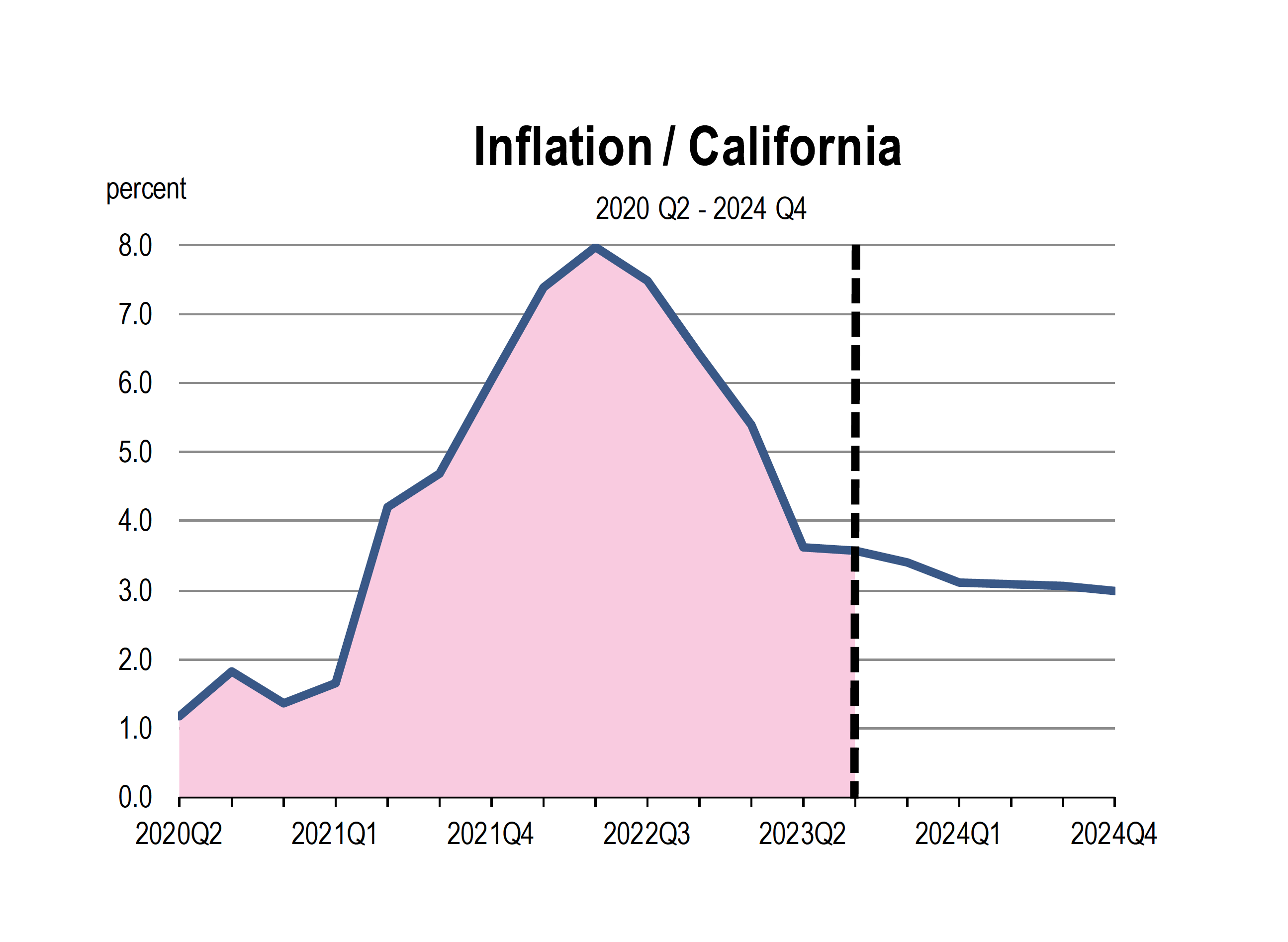

The growth in wages—-or simply put: wage inflation—was not that strong in September, and that is good news. Wage growth has now slowed to 4 percent for the last 12 months. We need to see growth slow further if general price inflation is going to be reduced to the Fed’s target of 2.0 percent. The Fed is most focused on wage growth and how it affects overall inflation.

Therefore, unless there is clear progress of inflation approaching the 2.0 percent target, continued aggressive monetary policy in the form of interest rate hikes are probable.

Slowdown in the Cards

Higher interest rates will ultimately take their toll on more than just the housing and new car sales markets.

Over the next 6 months, the labor market is very likely to show more pronounced slowdowns in job creation and job turnover, which is people quitting and switching jobs.

- Consumers are reeling in their spending

- Using credit to consume is less attractive with high interest rates

- Higher rates also discourage business investment, which slowed in May, June and July

- Fewer goods can be purchased with the same expenditure level, due to inflation

- Fewer goods sold mean less sales, lower earnings of corporations, and lower stock prices.

And though inflation is forecast to decelerate on a path towards the 2.0 percent target, stronger labor markets lengthen the time period for inflation to align with this target.

What You Can Expect

The UCLA Anderson School forecast has growth slowing to less than one percent by mid-2024.

Consumers are the reason due to inflation adjusted income and spending recording no or very low growth in 2024.

A bona fide recession is avoided but the economy grows so slightly that a tipping point is not unlikely, and a mild recession lasting two quarters is within the forecast error.

Corporate earnings will suffer with the decline in demand, and stock market corrections will be more likely in 2024.

Headline Inflation remains persistently in the 3.0 to 3.3 percent range.

Mortgage rates stay high throughout 2024 and begin to contract in 2025.

The labor market does not suffer much though wage pressures will largely though not entirely be diffused. Core inflation remains higher than 3.0 percent in 2024 and 2025.

The California Economic Forecast is an economic consulting firm that produces commentary and analysis on the U.S. and California economies. The firm specializes in economic forecasts and economic impact studies, and is available to make timely, compelling, informative and entertaining economic presentations to large or small groups.